Receiving a Reduction in Taxable Value

Each year, the Assessor will be reviewing single-family homes, condominiums, townhouses, multi-family, commercial, industrial and timeshare properties in Orange County. Eligible properties will receive a reduction in Taxable Value for the property tax year beginning July 1.

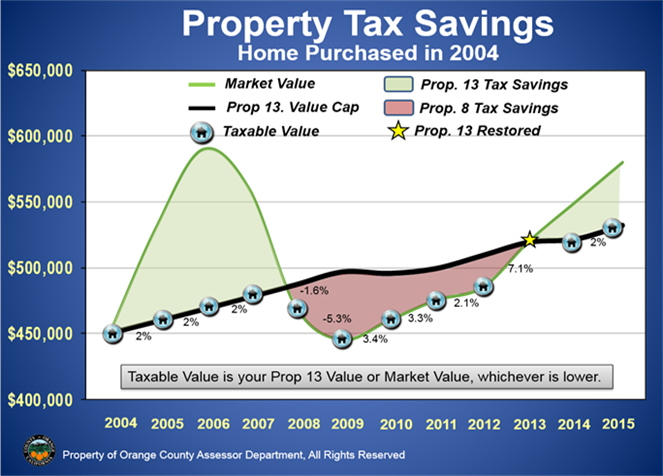

Property is valued each year as of January 1 (lien date) for property tax purposes. The Market Value is compared to the Prop. 13 Value. The Taxable Value is based on the lower value for that tax year.

Within the Proposition 13 limits, taxable value can be increased or decreased by more than 2% in one year.

| Q: |

Will a decline in market value reduce my property taxes? |

| |

Most California property owners do not pay taxes based on market value. Under Prop. 13, property is only assessed at market value when it changes ownership and when the market value drops below the Prop. 13 value. |

| Q: |

What is market value? |

| |

Market value is what the property would sell for in an open market transaction on January 1 (lien date) each year. How does the market value of your property compare to the Prop. 13 value on January 1? |

| |

· If the market value is lower than the Prop. 13 value, the Assessor will use the Market Value and your annual property taxes should go down. |

| |

· If the market value is higher than the Prop. 13 value, the Assessor is required to use the Prop. 13 value, even if the market value dropped significantly.

|

| |

Be aware that although your basic property tax levy may be reduced, your overall tax bill may go up if your property is subject to Mello-Roos assessments, water district or school district bonds or other special assessments. |

| Q: |

What is Prop. 13 Value? |

| |

Prop. 13 value is the market value of the property when you acquired it, plus a Consumer Price Index (CPI) adjustment of up to 2% per year, plus the value of any new construction. |

| Q: |

What is Taxable Value? |

| |

By law, the Assessor values property each year as of January 1. The Assessor compares the Prop. 13 value to the market value. Taxable value is always the lower of these two values, and is used for property tax calculations each tax year. Sales transactions and market activity through March 31 are considered to help determine market value. |

| Q: |

Do I have to submit a request to have my property value reviewed? |

| |

No, the Assessor is proactive in performing property reviews each year. However, property owners may submit a Request for Informal Assessment Review with information supporting their request for a lower assessed value between January 1 and April 30 each year.

To request an Informal Review, please complete a form based on the type of property to be reviewed:

-

Single-Family Residential Property (Homes, Condos and Townhouses)

-

Multi-Family Residential Property (Apartments)

-

Commercial/Industrial Property

-

Hospitality Property

|

| Q: |

When will I be notified of my property’s Taxable Value? |

| |

The Assessor may mail a Property Value Notice to owners in July or you will receive the property tax bill from the Tax Collector. The notice or tax bill will provide the taxable value that is used to calculate the property tax bill. |

| Q: |

When will I see a reduction in my property taxes? |

| |

Any value reduction will be included in the property tax bill sent by the Tax Collector in October.

Taxpayers have "Property Tax Savings", whether the market is up or down. |