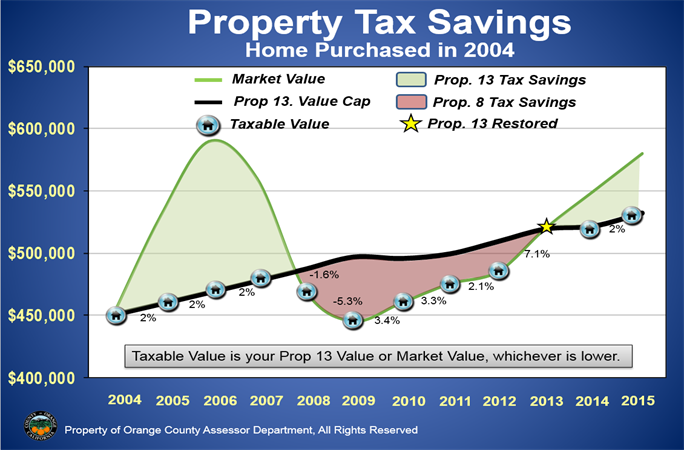

If your property received a reduction in Taxable Value in prior years due to decline in Market Value, you may see an increase this year.

Taxable Value reductions are temporary, and are based on the Market Value of property each January 1. When Market Value goes back up, Taxable Value will go back up with the market until it reaches the Prop. 13 Value Cap

This may take one year or many years, depending on how quickly the market recovers in your area. The Assessor can adjust values by more than 2% in one year, up or down, to adjust for changes in Market Value, but only up to the Prop. 13 Value Cap. Taxable Value will not go above the Prop. 13 Value Cap.

The example below demonstrates how Taxable Value can go up by more than 2% in one year when Market Value is lower than the Prop. 13 Value: